A4 Single Tax Exemption

Married Filing Jointly

As is the case with Federal returns, a married couple will generally pay less Alabama income tax if they file a joint return than they would if they used the Married Filing Separately designation. A couple can file a joint Alabama return if they are legally married on December 31 and living together on that date. Alabama does recognize common law marriages for income tax purposes. If one spouse is a resident of Alabama and the other spouse is a resident of another state, the couple may not file a joint return. They must file as Married Filing Separately.

If a spouse dies during the taxable year, the survivor may still file a joint return for that taxable year; but there is no Surviving Spouse status available for subsequent years as is the case under Federal law. If a spouse dies before the return for the previous year has been filed, the surviving spouse may file a joint return for that previous year, as well as for the year in which the death occurred. An Alabama income tax return cannot be amended after the original due date in order to change the filing status from Married Filing Jointly to Married Filing Separately.

A married couple filing a joint return claims a personal exemption of $3,000.

Married Filing Separately

If a couple is legally married and living together on December 31, they have the option of choosing to file separately rather than filing a joint return. Each spouse reports only his or her separate income, deductions, exemptions and credits. Alabama is not a community property state. When a married couple files separate returns, each spouse is entitled to a personal exemption of $1,500.

Head of Family

Alabama's definition of Head of Household(1) is linked to the federal definition which states that a taxpayer can claim Head of Family status if he is either unmarried or legally separated on December 31, is not a surviving spouse, and meets either of the two tests below:

- Test 1 -The taxpayer provided more than 50% of the cost of maintaining a home that was the main home of his parent, and he can claim that parent as a dependent. It is not necessary that the parent lived in the taxpayer's home; i.e., he may have provided more than half the cost of a separate home for his parent.

- Test 2 -The taxpayer provided more than 50% of the cost for the home where he lived and where one of the following also lived:

- His unmarried child, grandchild, great-grandchild, adopted child, or step-child. The child does not have to qualify as his dependent.

- A married child from the list in Number 1. The married child must qualify as his dependent, except in cases where the married child is being claimed by the taxpayer's divorced spouse as a dependent.

- Any relative that he can claim as a dependent.

An Alabama taxpayer claiming Head of Family Status is entitled to a personal exemption of $3,000.

Proration of Personal Exemption

A part year resident can claim the full personal exemption for his filing status on Form 40. There is no requirement to prorate the exemption amount. However, a nonresident using Form 40NR may claim only a fraction of the otherwise allowable personal exemption for his filing status. The numerator of the fraction is his total income from Alabama sources, and the denominator is his total income from all sources.This page last updated 2/8/13 |

This percentage exemption is added to any other home exemption for which an owner qualifies. The taxing unit must decide before July 1 of the tax year to offer this exemption. Optional age 65 or older or disabled exemptions: Any taxing unit may offer an additional exemption amount of at least $3,000 for taxpayers age 65 or older and/or disabled. You may not claim more personal exemptions on form VA-4 than you are allowed to claim on your income tax return unless you have received written permission to do so from the Department of Taxation. You may claim an exemption for yourself. Essentially, it translates to $5,312.00 per year of tax-free income for single Arizona taxpayers, and $10,613.00 for those filing jointly. The Personal Exemption, which is supported by the Arizona income tax, is an additional deduction you can take if you (and not someone else) are primarily responsible for your own living expenses.

State Tax Withholding State Code: 04. Basis For Withholding: Based on state taxable wages. Acceptable Exemption Form: A-4. Acceptable Exemption Data: 0.8, 1.8, 2.7, 3.6, 4.2, 5.1. TSP Deferred: Yes. Special Coding: Arizona state tax is based on a percentage of the Arizona State taxable wages. Determine the Total Number Of Allowances field as. This percentage exemption is added to any other home exemption for which an owner qualifies. The taxing unit must decide before July 1 of the tax year to offer this exemption. Optional age 65 or older or disabled exemptions: Any taxing unit may offer an additional exemption amount of at least $3,000 for taxpayers age 65 or older and/or disabled.

11-1134. Exemptions

A. The affidavit and fee required by this article do not apply to the following instruments:

1. A deed that represents the payment in full or forfeiture of a recorded contract for the sale of real property.

2. A lease or easement on real property, regardless of the length of the term.

3. A deed, patent or contract for the sale or transfer of real property in which an agency or representative of the United States, this state, a county, city or town of this state or any political subdivision of this state is the named grantor, and authorized seller, or purchaser.

4. A quitclaim deed to quiet title as described in section 12-1103, subsection B or otherwise executed for no monetary consideration.

5. A conveyance of real property that is executed pursuant to a court order.

6. A deed to an unpatented mining claim.

7. A deed of gift.

B. The affidavit and fee required by this article do not apply to a transfer of title:

1. Solely in order to provide or release security for a debt or obligation, including a trustee's deed pursuant to power of sale under a deed of trust.

2. That confirms or corrects a deed that was previously recorded.

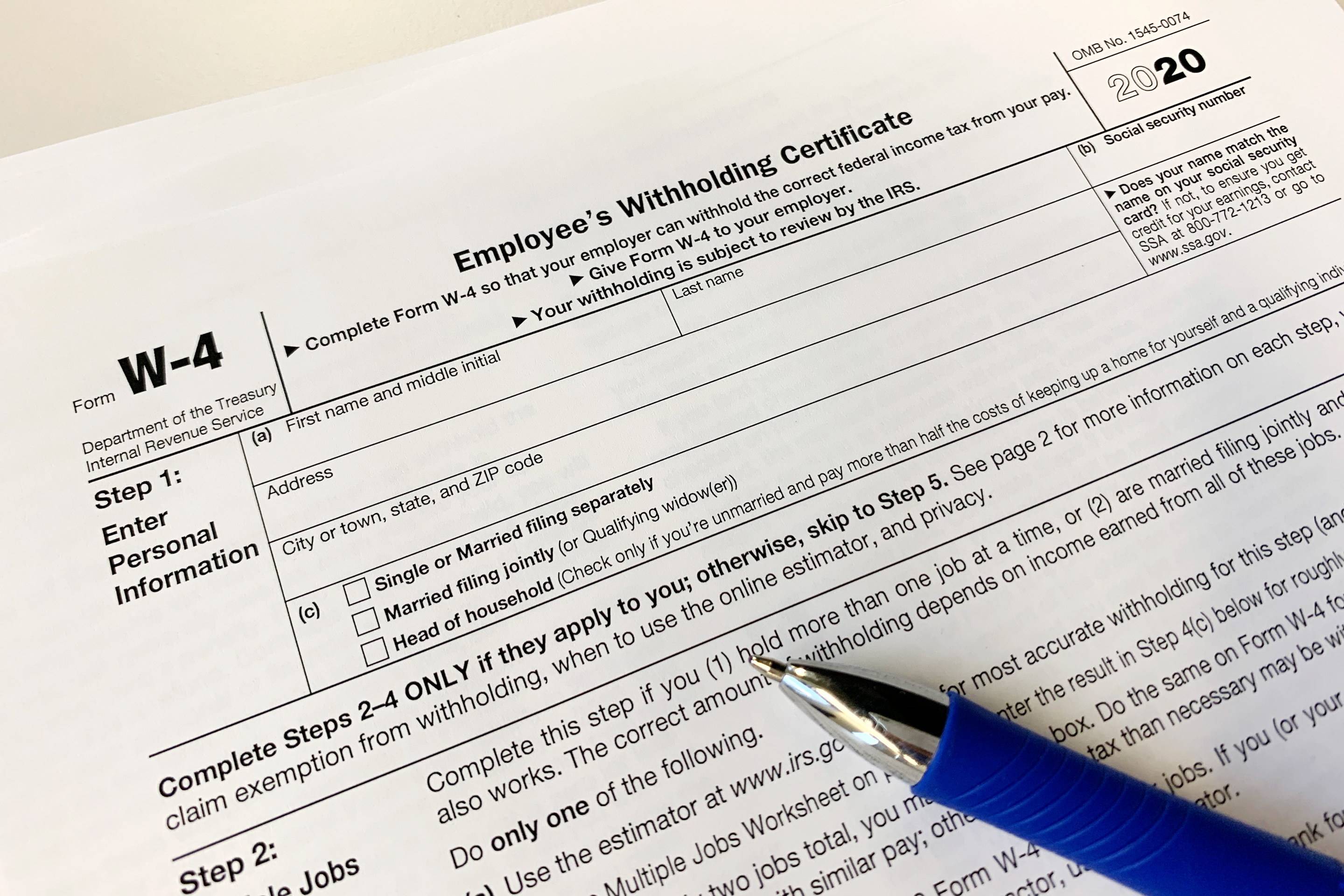

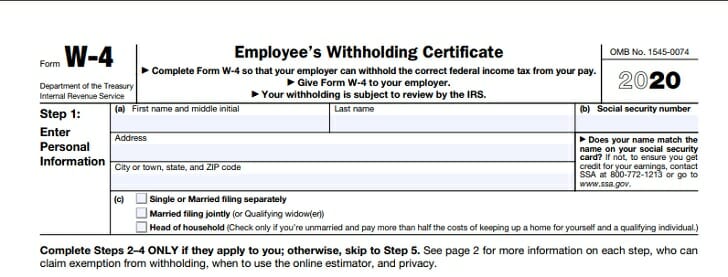

/Form-w4-e54ebb209cbc48b48541a54b07e2d5c2.jpg)

3. When the transfer of title has only nominal actual consideration for the transfer of residential property between:

(a) Husband and wife or ancestor of the husband and wife.

(b) Parent and child, including natural or adopted children and their descendants.

(c) Grandparent and grandchild.

(d) Natural or adopted siblings.

4. On a sale for delinquent taxes or assessments.

5. On partition.

6. Pursuant to a merger.

7. For no consideration or nominal consideration:

(a) By a subsidiary to its parent or from a parent to a subsidiary.

(b) Among commonly controlled entities.

(c) From a member to its limited liability company or from a limited liability company to a member.

A4 Tax Form Alabama

(d) From a partner to its partnership.

(e) From a partnership to a partner.

(f) From a joint venturer to its joint venture.

(g) From a joint venture to a joint venturer.

(h) From a trust beneficiary to its trustee.

A4 Tax Form Arizona

(i) From a trustee to its trust beneficiary.

(j) From any of the entities in subdivisions (a) through (i) of this paragraph to a single purpose entity in order to obtain financing.

8. From a person to a trustee or from a trustee to a trust beneficiary with only nominal actual consideration for the transfer.

9. To and from an intermediary for the purpose of creating a joint tenancy estate or some other form of ownership.

A4 Single Tax Exemption Due Date

10. From a husband and wife or one of them to both husband and wife to create an estate in community property with right of survivorship.

11. From two or more persons to themselves to create an estate in joint tenancy with right of survivorship.

12. Pursuant to a beneficiary deed with only nominal actual consideration for the transfer.

13. From an owner to itself or a related entity for no or nominal consideration solely for the purpose of consolidating or splitting parcels.

14. Due to a legal name change.

C. Any instrument that describes a transaction that is exempt under this section shall note the exemption on the face of the instrument at the time of recording, indicating the specific exemption that is claimed.